.GIF)

/about/ProfitLoss-569939cc3df78cafda9012ac.jpg)

.jpg)

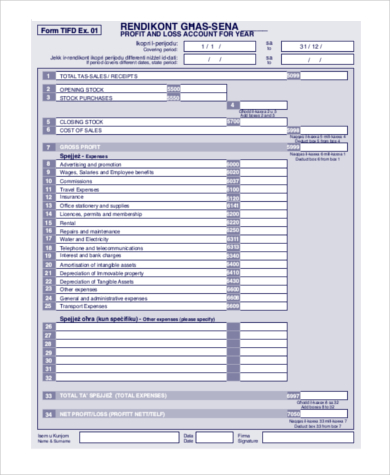

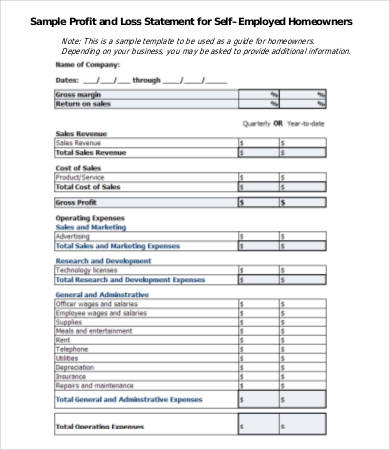

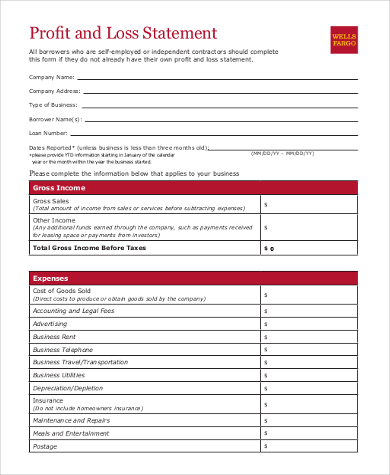

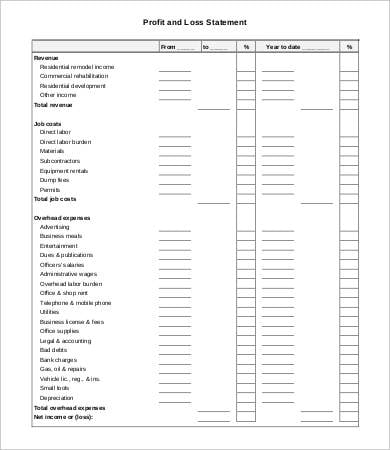

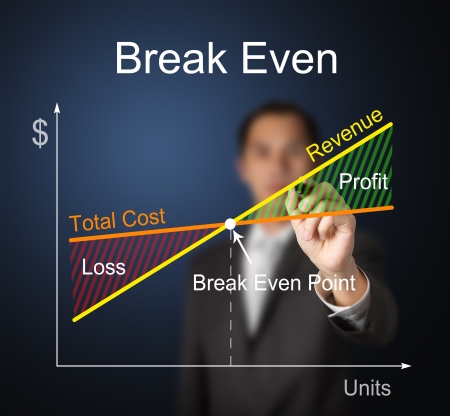

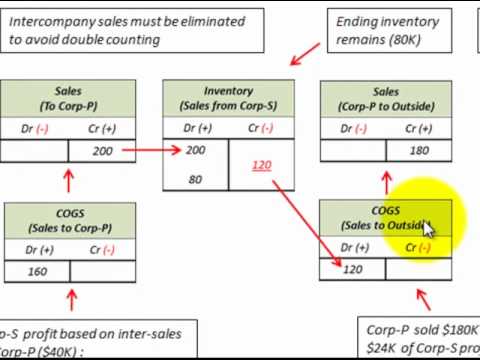

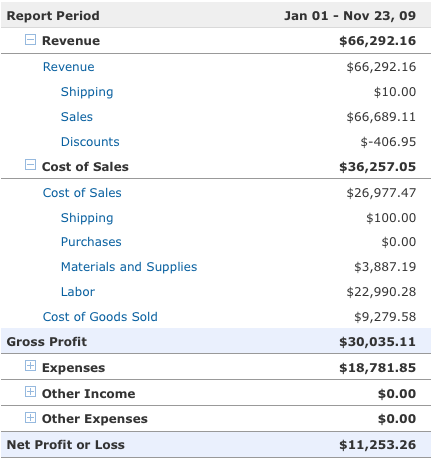

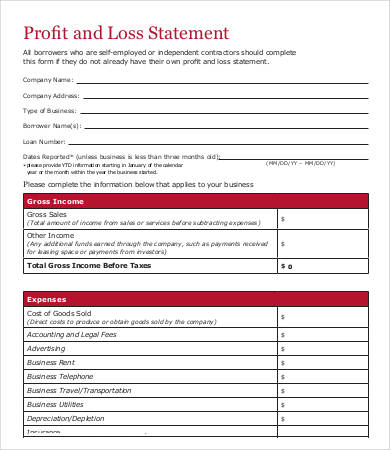

Profit is surely an absolute number determined by the quantity of income or revenue earlier mentioned and over and above the costs or charges a business incurs. It is calculated as overall revenue minus whole costs and seems on an organization's income statement.

Profit is surely an absolute number determined by the quantity of income or revenue earlier mentioned and over and above the costs or charges a business incurs. It is calculated as overall revenue minus whole costs and seems on an organization's income statement.1 oversight an organization or investor may possibly make is always to equate corporation growth, or an increase in sales, with a proportionate rise in profits. This doesn't consider into account the costs linked with the growth of a firm. As a firm grows, its expenditures will from time to time mature together with it, Most likely in a larger rate than sales.

I make the profiteroles and fill them with pastry product in place of ice cream, leading with the sauce (I make double generally) and afterwards I increase whipped cream with some cinnamon extra. I would take this as my previous meal in the world.

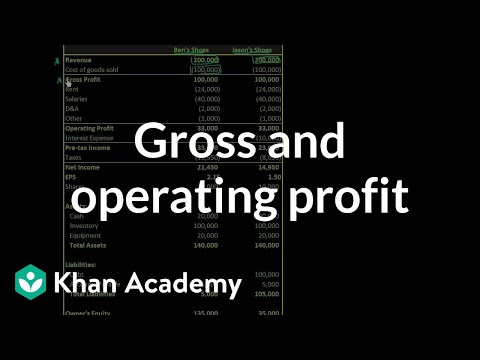

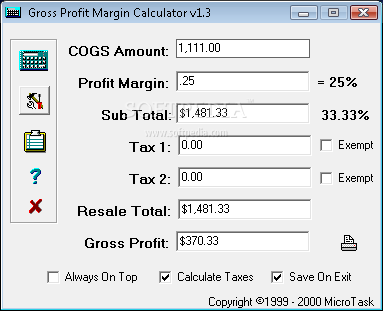

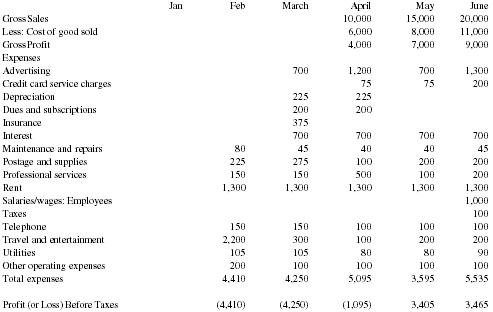

It tells managers, investors, and various stakeholders the percentage of revenue / sales remaining immediately after subtracting the cost of products sold ; the amount of cash still left over to pay for promoting, standard, and administrative fees which include salaries, research and enhancement, and marketing, which appear even more down the income statement.

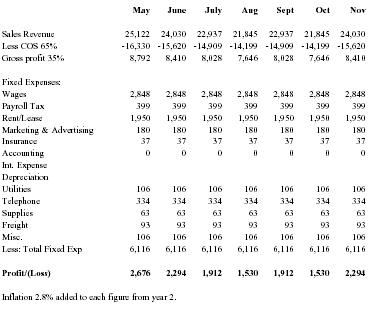

Nonetheless, there are lots of cash merchandise that are not income and cost objects, and vice versa. For example, the acquisition of a tractor is really a cash outflow should you pay cash at some time of invest in as shown within the example in Table 2. If money is borrowed for the purchase using a phrase bank loan, the down payment is really a cash outflow at enough time of purchase plus the yearly principal and interest payments are cash outflows each and every year as shown in Table three.

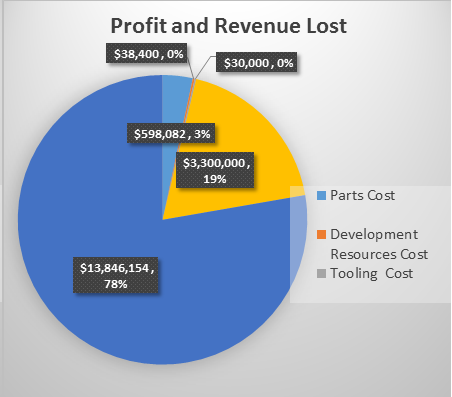

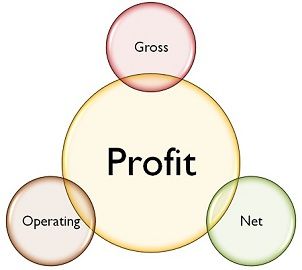

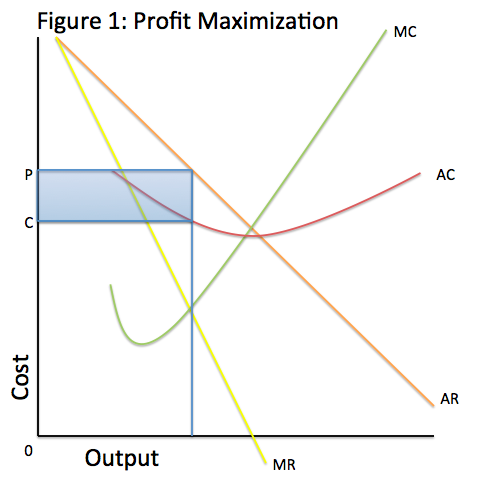

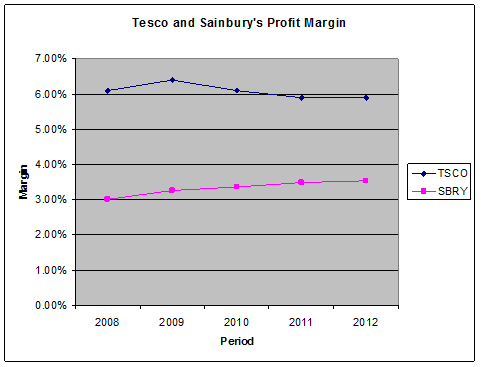

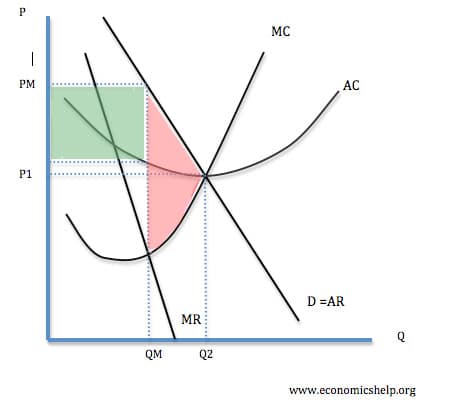

Gross margin steps the amount of a firm can mark up sales previously mentioned COGS. Operating margin may be the percentage of sales left soon after covering extra functioning cost. The pretax margin shows a company's profitability after additional accounting for nonoperating expenditure. Net profit margin considerations a firm's ability to generate earnings following taxes.

What is the difference between operating margin and contribution margin? Understand the difference between two measures of profitability, operating margin and contribution margin, and the purpose ... Read Solution >>

Although the formula is simplistic, making use of the principle is vital in that 4% of sales will lead to following tax profit.

Profit sharing generally occurs each year once the closing results for that annual enterprise profitability happen to be calculated.

I shall quickly turn into a large fish suit for that tables of the wealthy, and then you can catch me yet again, and come up with a handsome profit of me.

This is very true within industries and sectors due to the fact It really is doable to generate an improved apples-to-apples comparison among the opponents. A company able to boasting sustained gross profit margins which can be materially better than its Your Domain Name peers is nearly always more productive, greater operate, as well as a safer extended-term investment delivered the valuation several is just not also high.

The BBC isn't liable for the content of external sites. Read about our approach to external linking.

windfall profit - profit that occurs unexpectedly like a consequence of some occasion not controlled by those who profit from it

Exactly what is the difference between performance ratios and profitability ratios? Learn about effectiveness and profitability ratios, what these ratios evaluate and the principle difference between effectiveness and ... Read Solution >>